Funding for your Business

Many small business are underserved by traditional lenders. However, access to capital can be the key to unlocking growth for your business.

Buy Materials and Supplies

Renovate your space

Purchase Equipment

Open a new location

Minimum Criteria

Any business, from small to large, can get access to the needed capital as long as you meet these minimum requirements.

10k

Monthly Revenue

6 months

In Business

550

Credit Score

Simple steps, big impact.

Get loan offers that meet your specific business needs from several funders through Monefi.

Receivables Purchase

Lender purchases future revenue from sales at a discount and you pay back over a period of time with fixed daily or weekly payments.

Term Loan

Lump sum amount lent to the business, which is paid back over a period of time with regular scheduled payments determined by your credit profile.

Line of Credit

You can borrow up to a maximum credit limit and only pay interest on the amount of funds you draw from your credit line on a monthly basis.

Invoicing Factoring

Sell outstanding invoices to a lender who will pay you a portion of the amount up front. The remaining percentage is held until the invoice is paid by your customer and a fee is deducted.

Equipment Financing

Lender provides you the cash you need to purchase a piece of equipment. You pay back the total amount, plus interest, over a period of time.

Additional Lending Options

Accounts Receivable

Accounts receivable lines of credit are best for business owners who sell to other businesses on net terms and want the flexibility to access funds when they need them and pay them back as they get paid.

Ecommerce Marketplace

Businesses that primarily sell their product on marketplaces like Shopify, Amazon, or BigCommerce can use ecommerce marketplace financing by connecting all of their marketplaces to the funder's platform.

SBA Loan

SBA loans are government-guaranteed term loans. The guarantee allows the SBA approved lenders to offer low-interest rate loans to business owners who might not qualify for a traditional bank loan.

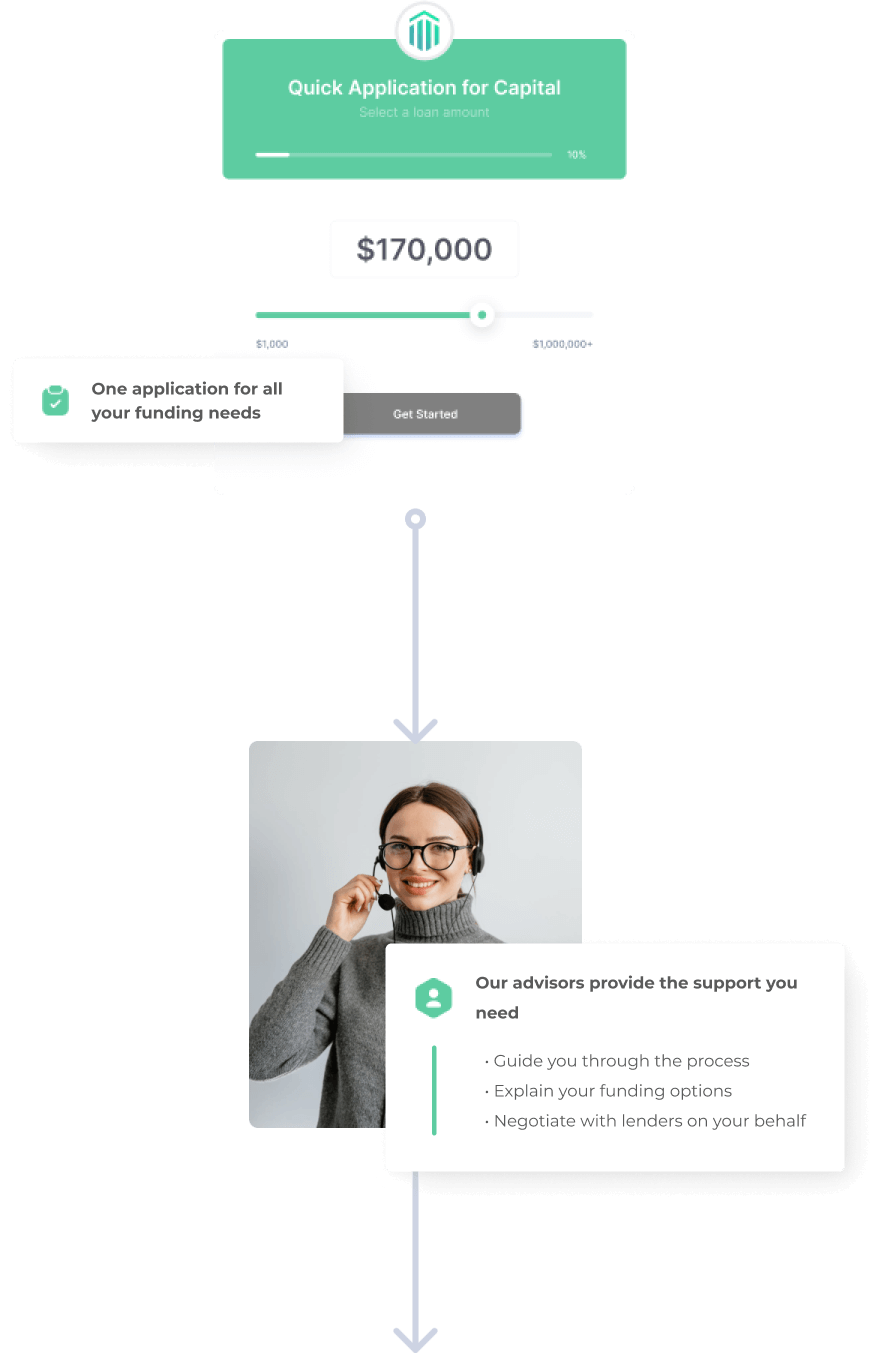

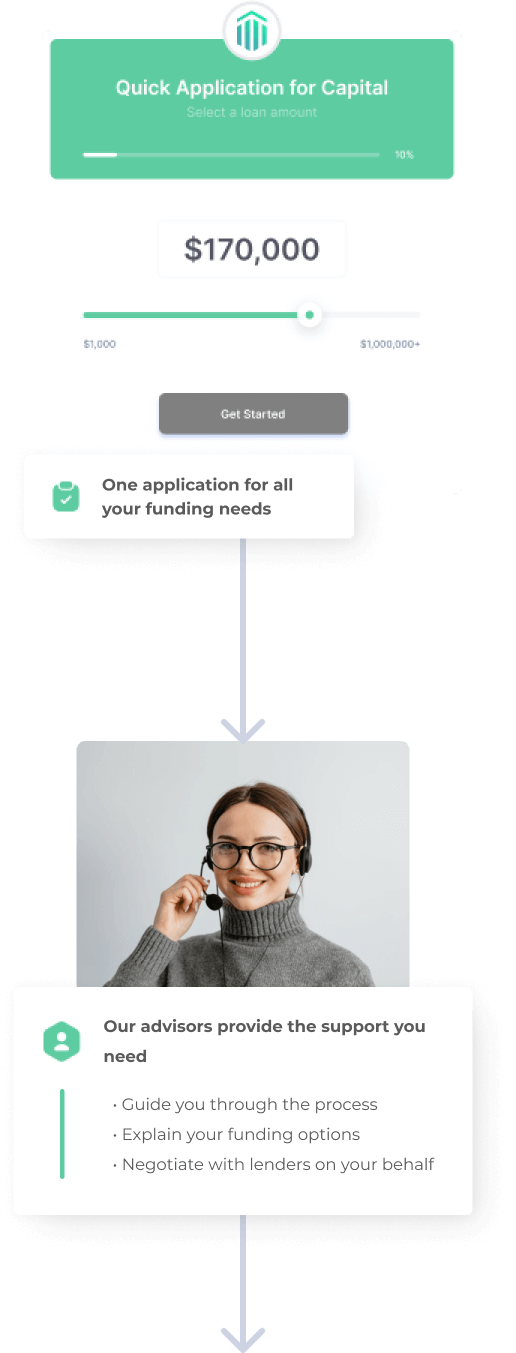

How the MoneFi Process Works

Apply

Fill out one simple application. There's no fee or obligation, and applying will not impact your credit.

Evaluate

Review loan offers with your dedicated funding advisor and pick the solution that works for you.

Fund

Get the capital in as little as 24 hours — deposited directly into your business account.

Grow

Put the money to work and get back to what you do best — growing your business!

FAQ

Wondering how Monefi works? We're an open book.

How long will it take to get funds after I've completed the application?

The timing can vary depending on several factors, including the completeness of your application and our assessment process. Typically, funds can be disbursed as quickly as 24 to 48 hours after approval for most of our products. However, some cases may take longer based on the specifics of your business needs and the product chosen.

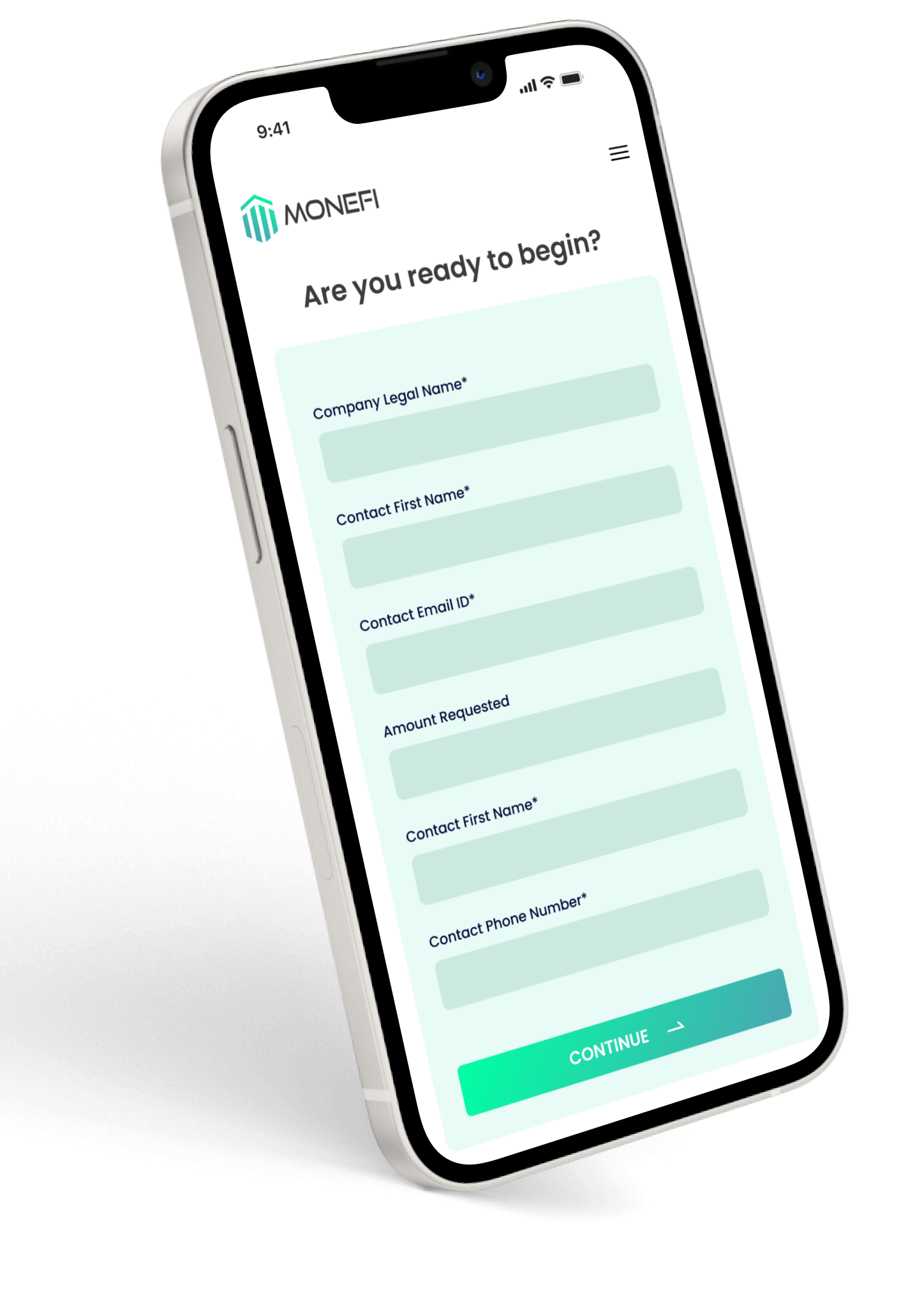

What's the process to apply for capital?

Applying for capital through MoneFi is straightforward:

✦ Complete the Online Application: Fill out our basic business and personal information form on our website.

✦ Submit Required Documents: Upload necessary documents such as business financials, proof of income, and identification.

✦ Review and Approval: Our team will review your application and reach out with any questions or for additional information. Once everything is verified, we'll make a decision on your application.

✦ Receive Funds: If approved, you'll receive the funds in your business account.

Will my credit be impacted when I apply?

Initially, we conduct a soft credit pull that does not affect your credit score to evaluate your application. However, if you proceed with the loan offer, a hard credit inquiry, which might slightly impact your credit score, may be performed as part of the final approval process.

What if I have a question about the process during the application stage?

We are here to help! You can reach out to your DEDICATED AGENT via phone, email, or live chat on our website. Our team is available to guide you through the application process and answer any questions you might have.

What products are available to me?

Answer: We offer a range of products tailored to the needs of small to medium-sized businesses, including:

✦ Business Loans: Flexible loans with competitive rates.

✦ Line of Credit: Access to funds as you need them, pay interest only on what you use.

✦ Invoice Factoring: Advance funds based on your accounts receivables. The availability of specific products may depend on your business's financial health, credit score, and operational history.

What will I be expected to provide during the application process?

You will typically need to provide:

✦ Business Financial Statements: Profit and loss statement, balance sheet, and cash flow statements.

✦ Tax Returns: Both business and personal for the last two years.

✦ Proof of Identity: Government-issued ID such as a passport or driver’s license.

✦ Business Plan: Especially for new businesses or those looking for substantial funding.

✦ Bank Statements: Typically for the last six months to verify income and cash flow.

Our Reviews